mercurius-digital.ru

Prices

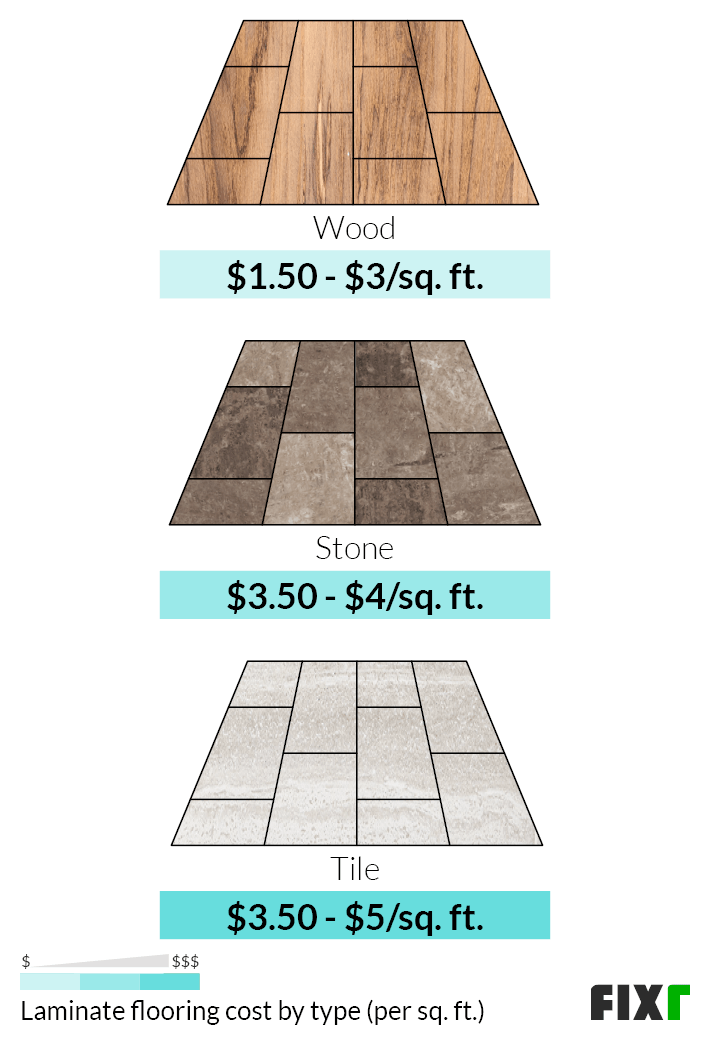

Cheapest Flooring Options Per Square Foot

Vinyl flooring is a popular choice among many homeowners since it is affordable and durable. It can easily withstand heavy foot traffic, spills, and pet. Laminated flooring starts at ₹75 per square foot. See the floors of these beautiful living rooms · living room Elad Gonen. We installed a sq ft wood laminate floor and paid around $ a sq ft. High-end hardwood flooring costs anywhere from $3 to more than $14 per square foot these days. Even for the tiniest of tiny homes, that can add up to. Vinyl plank flooring is an excellent budget-friendly option that can mimic the look of hardwood or ceramic tile. It's easy to install and maintain, making it a. For residential flooring costs, the range averages between $3 and $15 per square foot and obviously depend on the type of flooring. It can cost as low as $, but the average lies around $ per square foot along with the additional cost of installation. Mid-range is a medium thickness. Laminate flooring may cost between $ and $ per square foot, according to Home Depot, meaning it's sometimes about half as expensive as hardwood flooring. Ceramic tile is the most affordable option, with a cost ranging from $ to $5 per square foot, while natural stone tile can cost upwards of $15 per square. Vinyl flooring is a popular choice among many homeowners since it is affordable and durable. It can easily withstand heavy foot traffic, spills, and pet. Laminated flooring starts at ₹75 per square foot. See the floors of these beautiful living rooms · living room Elad Gonen. We installed a sq ft wood laminate floor and paid around $ a sq ft. High-end hardwood flooring costs anywhere from $3 to more than $14 per square foot these days. Even for the tiniest of tiny homes, that can add up to. Vinyl plank flooring is an excellent budget-friendly option that can mimic the look of hardwood or ceramic tile. It's easy to install and maintain, making it a. For residential flooring costs, the range averages between $3 and $15 per square foot and obviously depend on the type of flooring. It can cost as low as $, but the average lies around $ per square foot along with the additional cost of installation. Mid-range is a medium thickness. Laminate flooring may cost between $ and $ per square foot, according to Home Depot, meaning it's sometimes about half as expensive as hardwood flooring. Ceramic tile is the most affordable option, with a cost ranging from $ to $5 per square foot, while natural stone tile can cost upwards of $15 per square.

Stained concrete is an affordable option, averaging a professionally finished installed cost of $ per square foot. Stained concrete floors can mimic more. ft. But some better products might cost as much as $ - $ per square foot. Floating click and lock laminate is very easy to install and many homeowners. At only around $1 per square foot, Style Smart Carpet Tiles are the most affordable way to achieve the look. Style Smart Carpet basement flooring not only. However, on average, you can expect to pay between $2 and $4 per square foot for materials and labor. Installing vinyl plank floors. If you are DIY-ing your. Sheet vinyl flooring will be the least expensive flooring for a bathroom - frequently available for under $1. / square foot. Installation is. Laminate flooring is durable and installation is usually easy. It's one of the most economical flooring options, costing $3-$7 per square foot on average. Vinyl, laminate, and some kinds of tile can all cost under $1 per square foot. However, you can't just pick up one of these cheap flooring choices at random and. Sheet vinyl, linoleum, engineered hardwood, carpet, and vinyl plank are all popular choices when searching for affordable solutions that will last. Today, vinyl flooring is available in tile, plank and sheet form. One of the most affordable, resilient and versatile flooring options, it's an ideal choice. Our price per sq. ft. for carpet, laminate, vinyl and hardwood flooring includes all materials and installation costs. explore the Cheapest flooring options per square foot, low-cost and easy to install if you are on a budget- carpet is the most inexpensive option followed. The most inexpensive flooring options are typically vinyl and linoleum. Vinyl is a durable material that can be used in a variety of settings. LOT PURCHASE - Bel-Air Collection - Newport Bourbon Oak - Rigid Core Waterproof Flooring 7" x 48" Waterproof Luxury Vinyl Plank Flooring DE OTHER FLOORING MATERIALS Average carpet prices start at $2 per square foot and increase with quality. Mid-grade quality carpet ranges from $3 to $4 per square. sq/ft) installed. $$ sq/ft to refinish. Water resistant, hygienic design options. Plastic Tile. Plastic such as. PVC,Polypropyl ene/ethylene. Pros and Cons of the Top Flooring Choices · Hardwood Floors · Ceramic and Porcelain Tile · Luxury Vinyl Tile (LVT) and Plank (LVP) · Carpet · Laminate Floors. Carpet is a comfortable, low-maintenance flooring option. A new carpet installation will cost about $ to $11 per square foot, or more, depending on the type. Vinyl or linoleum will be your most affordable options, with the lowest end starting around $ per square foot. Average Price: $ Average Total Project Cost: $ - $ per sq. ft. Installation: $ - $ per sq. ft. Materials: $ per sq. ft. Underlayment: $ per sq. ft. Sleek and stylish kitchen flooring can cost anywhere from $20 to $30 per square foot, but if you shop around and do the installation yourself, inexpensive.

7 Year Treasury Rate

PM EDT 09/03/ Yield. %; Price. 1/32; 26/32 (%). 1 Day Range - 52 Week Range (Yield) - (08/05/24 - 10/19/23). The ICE U.S. Treasury Year Bond Index includes publicly-issued U.S. Treasury securities that have a remaining maturity of greater than seven years and less. TMUBMUSD07Y | View the latest U.S. 7 Year Treasury Note news, historical stock charts, analyst ratings, financials, and today's stock price from WSJ. U.S. Treasury yields and swap rates, including the benchmark year U.S. Treasury 7 Year, %, %, %. 10 Year, %, %, %. 30 Year. 1 YR FXR NOTE 10 YR FXR BOND 15 YR FXR BOND DAY BILL 2 YR FXR NOTE 20 YR FXR BOND 3 YR FXR BOND DAY BILL 5 YR FXR BOND 56 DAY. United States 7-Year Bond Yield ; Prev. Close: ; Day's Range: ; 52 wk Range: ; Price: ; Price Range: 7 Year Treasury Rate is at %, compared to % the previous market day and % last year. This is lower than the long term average of %. At that time Treasury released 1 year of historical data. View the Daily Treasury Par Real Yield Curve Rates · Daily Treasury Bill Rates. These rates are. We sell Treasury Notes for a term of 2, 3, 5, 7, or 10 years. Notes pay a fixed rate of interest every six months until they mature. PM EDT 09/03/ Yield. %; Price. 1/32; 26/32 (%). 1 Day Range - 52 Week Range (Yield) - (08/05/24 - 10/19/23). The ICE U.S. Treasury Year Bond Index includes publicly-issued U.S. Treasury securities that have a remaining maturity of greater than seven years and less. TMUBMUSD07Y | View the latest U.S. 7 Year Treasury Note news, historical stock charts, analyst ratings, financials, and today's stock price from WSJ. U.S. Treasury yields and swap rates, including the benchmark year U.S. Treasury 7 Year, %, %, %. 10 Year, %, %, %. 30 Year. 1 YR FXR NOTE 10 YR FXR BOND 15 YR FXR BOND DAY BILL 2 YR FXR NOTE 20 YR FXR BOND 3 YR FXR BOND DAY BILL 5 YR FXR BOND 56 DAY. United States 7-Year Bond Yield ; Prev. Close: ; Day's Range: ; 52 wk Range: ; Price: ; Price Range: 7 Year Treasury Rate is at %, compared to % the previous market day and % last year. This is lower than the long term average of %. At that time Treasury released 1 year of historical data. View the Daily Treasury Par Real Yield Curve Rates · Daily Treasury Bill Rates. These rates are. We sell Treasury Notes for a term of 2, 3, 5, 7, or 10 years. Notes pay a fixed rate of interest every six months until they mature.

U.S. 7 Year Treasury Note ; Open % ; Day Range - ; 52 Week Range - ; Price 8/32 ; Change 1/

Price Yield Calculator ; Price, $ ; % ; Modified Duration, years ; Spread of ACF Yield (%) over yr Treasury Yield (%) As of 09/03/24 is. In depth view into 7 Year Treasury Rate including historical data from to , charts and stats. 7-Year Year U.S. Treasury Note futures. CODE: TYVY. CVOL: CHANGE: + Last Updated PM CT. PRODUCTS. Micro Treasury Yield. Decomposition of Treasury Yields ; 2-year, , , ; year, , , Open%. Day Range - ; 52 Wk Range - Price 7/32 ; Change1/ Change Percent%. United States 7-Year Bond Yield ; (%). Real-time Data ; Day's Range. 52 wk Range. US 10 Year Note Bond Yield was percent on Friday September 6, according to over-the-counter interbank yield quotes for this government bond maturity. US 7 Year Note Bond Yield was percent on Thursday September 5, according to over-the-counter interbank yield quotes for this government bond maturity. Current benchmark bond yields · 2 year - , % (); · 3 year - , % (); · 5 year - , % (); · 7. The iShares Year Treasury Bond ETF (IEF) seeks to track the investment results of an index composed of US Treasury bonds with remaining maturities between. The CMT yield values are read from the par yield curve at fixed maturities, currently 1, 2, 3, 4 and 6 months and 1, 2, 3, 5, 7, 10, 20, and 30 years. This. Graph and download economic data for Market Yield on U.S. Treasury Securities at 7-Year Constant Maturity, Quoted on an Investment Basis (DGS7) from. Rate Notes (FRNs) STRIPS Forms for Treasury Marketable Securities Treasury Hunt Year, UD8, No, 09/03/, 08/15/, %, %. Year. Graph and download economic data for Market Yield on U.S. Treasury Securities at 5-Year Constant Maturity, Quoted on an Investment Basis (DGS5) from. U.S. 10 Year Treasury Note ; 52 Week Range - ; Price 2/32 ; Change 0/32 ; Change Percent % ; Coupon Rate %. Treasury Yields ; GB3:GOV. 3 Month. ; GB6:GOV. 6 Month. ; GBGOV. 12 Month. ; GT2:GOV. 2 Year. ; GT5:GOV. 5 Year. Key Data ; Open%. Day Range ; 52 Wk Range - Price ; Change-1/ Change Percent ; Coupon Rate%. Maturity. While bonds are a generic name for debt securities, Treasury bonds, or T-bonds, refer specifically to U.S. government bonds with maturities of 20 to 30 years. 1-year, , , , 2-year, , , , 3-year, , , , 5-year, , , , 7-year, , , , Bonds ; ^TNX CBOE Interest Rate 10 Year T No. (%). , % ; ^TYX Treasury Yield 30 Years. (%). , %.

How To Pay Off Overdraft With Credit Card

In most cases, it isn't possible to overdraft a credit card, or spend above your credit limit. If you opt in to over-the-limit charges, it may be possible to. Typically, though, credit cards work better for planned or predictable expenses that you intend to pay off over time. Overdrafts work best in emergency. Four ways to pay off your overdraft · 1. Use your savings · 2. Switch to a cheaper overdraft provider · 3. Consider a low-rate personal loan · 4. Move your. At the end of the loan term everything will be paid off, so long as you've made all of the required payments. The structured nature of a personal loan also. Gradually reduce your overdraft · Use a credit card or savings to pay it off · Separate your overdraft from your day-to-day banking. For those who qualify, using a balance transfer card is the most active approach to paying off your credit card debt because it involves moving your debt to a. Another option is a money transfer credit card with a 0% interest period. This type of credit card lets you transfer money into your bank account (typically for. You could also link a credit line or a credit card to cover an overdraft. pay off an overdraft and any applicable fees. An overdraft loan can help you. Generally, you can get up to 12 months at 0% on these cards. Make sure you ask the bank to close your overdraft facility once it's paid off, so you're not. In most cases, it isn't possible to overdraft a credit card, or spend above your credit limit. If you opt in to over-the-limit charges, it may be possible to. Typically, though, credit cards work better for planned or predictable expenses that you intend to pay off over time. Overdrafts work best in emergency. Four ways to pay off your overdraft · 1. Use your savings · 2. Switch to a cheaper overdraft provider · 3. Consider a low-rate personal loan · 4. Move your. At the end of the loan term everything will be paid off, so long as you've made all of the required payments. The structured nature of a personal loan also. Gradually reduce your overdraft · Use a credit card or savings to pay it off · Separate your overdraft from your day-to-day banking. For those who qualify, using a balance transfer card is the most active approach to paying off your credit card debt because it involves moving your debt to a. Another option is a money transfer credit card with a 0% interest period. This type of credit card lets you transfer money into your bank account (typically for. You could also link a credit line or a credit card to cover an overdraft. pay off an overdraft and any applicable fees. An overdraft loan can help you. Generally, you can get up to 12 months at 0% on these cards. Make sure you ask the bank to close your overdraft facility once it's paid off, so you're not.

overdraft protection and linked a USAA Bank credit card as your protecting account. payments using the USAA Pay Bills service, and recurring debit card. Spending above your overdraft limit can lower your credit score. It may appear as if you're struggling with credit to the lender. Thus, an arranged overdraft. Extra courtesy pay works just like regular courtesy pay, but it also covers non-recurring everyday debit card transactions. If you're interested in extra. Most debit cards are linked to a bank or credit union account and can't go negative, i.e. overdraft unless that's set up on the account. There. The first is by visiting a teller at your bank. You can ask the teller to withdraw funds from your credit card and deposit them into your bank. Four ways to pay off your overdraft · 1. Use your savings · 2. Switch to a cheaper overdraft provider · 3. Consider a low-rate personal loan · 4. Move your. Move your overdraft to a 0% money transfer credit card: Finding a 0% money transfer credit card might be challenging, but it can allow you to transfer the. Some banks also offer an overdraft line of credit, which you may be able to borrow from, but later you'll have to pay the overdrawn amount plus interest. Now. If you do opt-in for overdraft protection or coverage, then your bank may pay a debit card purchase or ATM transaction, even if the transaction overdraws your. Create a budget. Budgeting is key to reducing your spending and can help you pay off your overdraft faster. · Use your savings. If you have savings, this. Overdraft Protection covers all transaction types – including, for example, ATM and debit card transactions, checks, Bill Pay, and recurring electronic. Overdraft transfer lets you link your account to your credit card. This means that, if your account is overdrawn, a cash advance from your credit card. To help prevent overdrafts, turn off Debit Card Coverage and we won't If Debit Card Coverage is turned on, we may pay the overdraft transaction and charge you. Credit Card · Gift Card · TD For when the unexpected happens—enroll in this option and we may authorize and pay one-time debit card or ATM transactions. Overdraft services from Mountain America. Explore the options below to ensure your checking or debit card transactions clear in the event your account balance. Protect yourself against unexpected overdrafts and bounced checks by linking your Wells Fargo Credit Card to your checking account. Recurring debit card transactions (such as insurance payments or monthly Please refer to the line of credit or credit card agreement for full details. Loans payments; Credit cards payments; Overdrafts. To avoid this, you should: Talk to your bank; Tell them you are struggling to pay. Get free debt advice if. credit card or a line of credit account. How do I set up or change Balance A recurring debit card payment such as for a gym membership or. If you are enrolled in Debit Card Overdraft Coverage, we also cover ATM and Debit Card transactions of $5 or less. If you have an Overdraft Line of Credit, you.

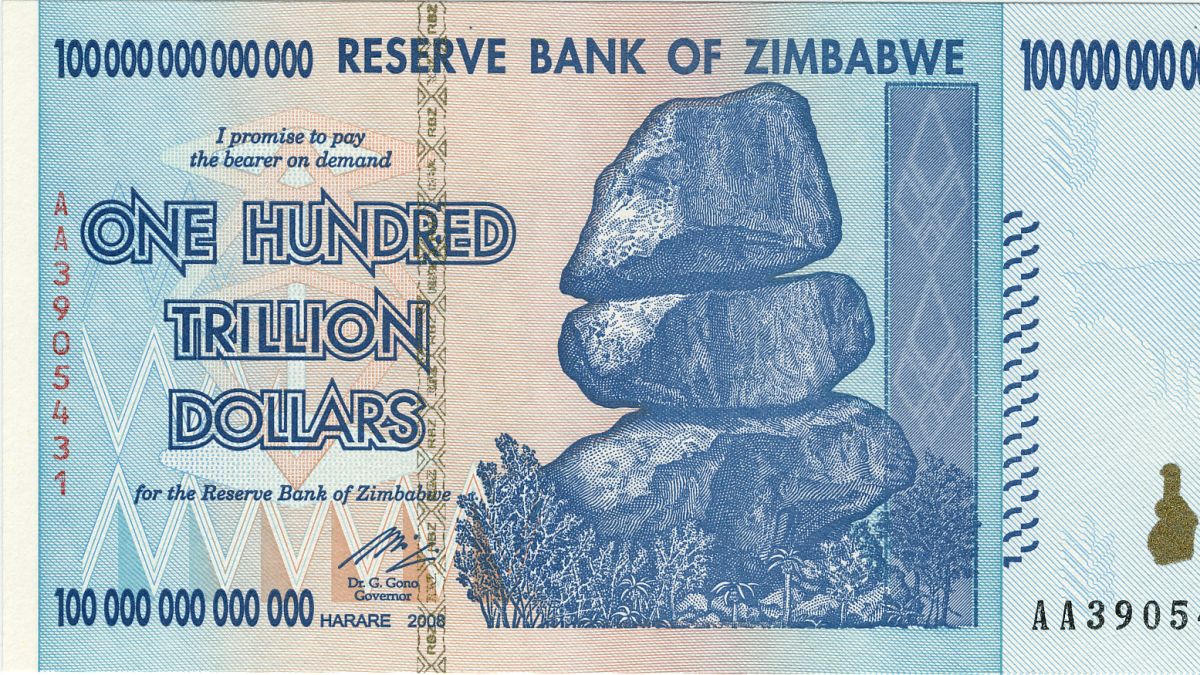

How Much Is 1 Trillion Dollars In Zimbabwe

As of Tuesday (08th Oct ) trillion Zimbabwe dollars is supposedly worth USD (ZWD) Zimbabwe dollar(ZWD). DONT MISS THIS GREAT PRICE OPPORTUNITY Zimbabwean Reserve Bank notes AA Series 10 20 50 Trillion Dollars. images are generic - serial numbers will differ. The $1 billion dollar Zimbabwe note is one of the largest notes ever issued. Hyperinflation in Zimbabwe was a period of currency instability that began in the. Banknote of Zimbabwe of one hundred trillion dollars. This banknote has the highest nominal value in history. The hyper-inflation in Zimbabwe in and value from 1 dollar to Trillion dollars in 6 months. The daily inflation rate in mid-November was 98%, with prices doubling every hours. In. ) percent year-on-year in mid-November Zimbabwean banknotes ranging from 10 dollars to billion dollars printed within a one-year period. MAKE OFFER~Zimbabwe Trillion Dollars ($)AA UNC~1 Piece ~BEST PRICE~. $ or Best Offer. Only 1 left! Our Zimbabwe trillion dollars banknotes have been sold by mercurius-digital.ru are always in condition as listed, and Dated ,,,, (one hundred trillion and three) Zimbabwe dollars Probably a lot of money to be made melting 1 Zim coins down for scrap. As of Tuesday (08th Oct ) trillion Zimbabwe dollars is supposedly worth USD (ZWD) Zimbabwe dollar(ZWD). DONT MISS THIS GREAT PRICE OPPORTUNITY Zimbabwean Reserve Bank notes AA Series 10 20 50 Trillion Dollars. images are generic - serial numbers will differ. The $1 billion dollar Zimbabwe note is one of the largest notes ever issued. Hyperinflation in Zimbabwe was a period of currency instability that began in the. Banknote of Zimbabwe of one hundred trillion dollars. This banknote has the highest nominal value in history. The hyper-inflation in Zimbabwe in and value from 1 dollar to Trillion dollars in 6 months. The daily inflation rate in mid-November was 98%, with prices doubling every hours. In. ) percent year-on-year in mid-November Zimbabwean banknotes ranging from 10 dollars to billion dollars printed within a one-year period. MAKE OFFER~Zimbabwe Trillion Dollars ($)AA UNC~1 Piece ~BEST PRICE~. $ or Best Offer. Only 1 left! Our Zimbabwe trillion dollars banknotes have been sold by mercurius-digital.ru are always in condition as listed, and Dated ,,,, (one hundred trillion and three) Zimbabwe dollars Probably a lot of money to be made melting 1 Zim coins down for scrap.

Over the course of the five-year span of hyperinflation, the inflation rate fluctuated greatly. At one point, the US Ambassador to Zimbabwe predicted that it. In , the government announced that those who had bank accounts could exchange 35 quadrillion Zimbabwe dollars for 1 USD in those accounts. Traders in. One hundred trillion dollar Zimbabwean note. ', Theme: Patriotism:Featuring a patriotic theme, this banknote celebrates Zimbabwe's heritage., Keywords: dollar to zimbabwe, nine dollar, how much is At the time of writing, 1 ZWL is worth USD. Once you know that information, multiply the amount you have in USD by the current exchange rate. The. RF FJ–One hundred trillion dollars banknote issued in Zimbabwe in , on the climax of the hyperinflation. White background. heart_plus. download. Zimbabwean dollars, Zimbabwe's newly formed unity government — One hopes some of those $ trillion notes didn't get spent all in one place. If you've wondered what a Zimbabwe One Hundred Trillion Dollar Banknote looks like, you have come to the right place. Zimbabwe experienced a period of. This Coins & Money item by Noveltycat has 4 favorites from Etsy shoppers. Ships from Germany. Listed on Jun 1, Anyone who has been to Victoria Falls, Zimbabwe has had the surreal experience of seeing a real $ trillion dollar bill. $ Trillion Zimbabwean (ZWL) dollars is worth somewhere between 10 billion and 17 USD as of today (12 Dec ) depending on the valuation. The good news, I have billion in my house right now. The bad news these are Zimbabwe dollars I bought online for like $3 U.S. dollars. 1 Trillion x10^ Zeroes). Reserve Bank of Zimbabwe Material: Polyethylene, Gold Foil. The currency converter below is easy to use and the currency rates are updated frequently. This is very much needed given the extreme volatility in global. At this point why not create a new currency where 1 new zimbabwe dollar = 1 trillion old dollar? dollars (ZWD) (or 1 trillion third dollars). This trillion dollar note is one of the world's largest denominations of currency. It was issued in Zimbabwe in during a period of hyperinflation. Reserve Bank Trillion Zimbabwe Dollars 24K Gold Banknote One Hundred Trillion Dollars A: Standard quality control, OEM accepted,most factory price. New Zimbabwe One Millillion Yottalillion Dollars Gold Foil Banknote Reserve Bank of Zimbabwe One Trillion Golden. 1/8. 0. US $ US $% off. Price shown. Zimbabwe currency (ZWD) in general all have the same design from the series but these 50 trillion notes differ in denomination (50,,,,) and. However, in , millions of ten, fifty and one hundred trillion dollars notes were printed. Though these notes have no currency value today, they do.

Lowest Balance Transfer Rate

BECU offers a low-rate and a Cash Back credit card that offers % cash back on every purchase. BECU also offers affinity card designs. Transfer your credit card balance to Addition Financial and pay 0% APR for 12 months. You'll save big, plus get great extras, like Cash Back or Rewards. There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be. A PSECU credit card balance transfer offers no annual fee and no PSECU balance transfer fee. Learn more reasons to apply for a PSECU Visa balance transfer. Highlights: · A balance transfer credit card moves your outstanding debt from one or more credit cards onto a new card, typically with a lower interest rate. And keep the savings going with low interest rates of % on purchases and % on balance transfers afterwards (% on cash advances). Genius Rating. Take advantage of a great low introductory rate on balance transfers to help manage your debt. With an APR as low as % and no annual or balance transfer fees, our low rate credit card is great for large purchases you want to pay off over time. A balance transfer fee is generally 3% or 5% of the amount you transfer. So a $5, balance transfer with a 5% fee would come out to $ This fee is often. BECU offers a low-rate and a Cash Back credit card that offers % cash back on every purchase. BECU also offers affinity card designs. Transfer your credit card balance to Addition Financial and pay 0% APR for 12 months. You'll save big, plus get great extras, like Cash Back or Rewards. There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be. A PSECU credit card balance transfer offers no annual fee and no PSECU balance transfer fee. Learn more reasons to apply for a PSECU Visa balance transfer. Highlights: · A balance transfer credit card moves your outstanding debt from one or more credit cards onto a new card, typically with a lower interest rate. And keep the savings going with low interest rates of % on purchases and % on balance transfers afterwards (% on cash advances). Genius Rating. Take advantage of a great low introductory rate on balance transfers to help manage your debt. With an APR as low as % and no annual or balance transfer fees, our low rate credit card is great for large purchases you want to pay off over time. A balance transfer fee is generally 3% or 5% of the amount you transfer. So a $5, balance transfer with a 5% fee would come out to $ This fee is often.

The introductory rate may be as low as 0% and last anywhere from six to 18 months. The challenge: Transferring a balance means carrying a monthly balance, and. I think most cards offer 0% introductory periods alongside their balance transfer periods when opening a new card. As for the fee, you won't get around that. Balance transfers must be completed within 4 months of account opening. There is a balance transfer fee No Annual Fee – our low intro rates and all the. Moving high-interest debt to a credit card with 0% APR can be a big money-saver! Generally, you'll have to pay a balance transfer fee — usually, 3% to 5% of the. Bank of America has credit cards that offer low intro APRs on qualifying balance transfers for those looking to manage one card while paying down credit card. Best 0% balance transfer cards ; Santander. - 26mths 0%. - 3% fee (min £5). - % rep APR · Apply* ; Virgin Money. - 20mths 0%. - 2% fee. - % rep APR. Check. It offers a 0% intro APR on balance transfers for 18 months. After that, the standard variable APR will be % to %. An intro balance transfer fee of. I've searched for such as well, and the best I can find is Wells Fargo Reflect Card which has 0% APR for 21 months and 5% transfer fee, which is. Highlights: · A balance transfer credit card moves your outstanding debt from one or more credit cards onto a new card, typically with a lower interest rate. The Tangerine Money-Back Credit Card offers an advantageous balance transfer option to new cardholders, who pay just % There's a % transfer fee* and no. Pay down higher-rate credit card debt and save money on interest. with a low intro APR balance transfer from Discover it® Cash Back Credit Card. Apply Now. 0% intro APR for 15 months; % - % variable APR after that; Balance transfer fee applies. balance transfer card with a low or 0% introductory APR. With an APR as low as % and no annual or balance transfer fees, our low rate credit card is great for large purchases you want to pay off over time. A balance transfer fee is a charge imposed by a lender to transfer existing debt over from another institution. · Credit card companies commonly offer balance. %, % or % variable APR thereafter. Balance transfers made within days from account opening qualify for the introductory rate. Annual fee. $0. In exchange for taking on your debt, credit card issuers will often charge you a fee, which is known as balance transfer fee. Typically, balance transfer fees. Best for no fees: Citi Simplicity® Card. With no annual fee, late fees, or penalty APR, the Citi Simplicity® Card stands out as a consumer-friendly option. Are you considering transferring your credit card debt to a “teaser rate” card (where a very low interest rate is charged on balance transfers for a specific. Because we don't charge a balance transfer fee or annual fee, you can pay off your balance faster. Both of our credit cards offer competitive low rates, which. On the other hand, if you switch to a card offering a low-interest rate on balance transfers, you can transfer that $5, balance to your new card and pay it.

Digital Savings Account India

Digital Savings Account - Open a Digital Bank Online with DBS bank instanly. Earn attractive interest rates & enjoy exclusive privileges and benefits. With % paperless process, an individual can open a digital savings account with zero balance and manage their funds from anywhere, at any time. What's more. Open HDFC Bank savings account from your home & get insurance cover up to Rs Cr*. Get preferential loan rates & bank locker with HDFC Bank savings. Customer On-Boarding using TAB. Advantages of TAB Banking Instant digital On Boarding of the new customers in a fully assisted mode at their doorsteps. Read. Enjoy instant banking services on the GO. Paperless account opening through Video-KYC. Open account in your preferred branch digitally. With a DBS Bank Savings Account, you can enjoy modern intelligent banking solutions, including digital gold investments and top-rated mutual fund schemes. IDFC FIRST Bank offers competitive interest rates up to % p.a., one of the bests in industry on digital savings accounts. IPPB's Digital Savings Account is the best way to onboard yourself through the IPPB Mobile App. This app can be downloaded from the play store on your Android. Amaze Digital Savings Account. Initial Funding: ₹10,, Average Balance Requirement. Debit Card fees: Nil, Average Monthly Balance - NIL. Digital Savings Account - Open a Digital Bank Online with DBS bank instanly. Earn attractive interest rates & enjoy exclusive privileges and benefits. With % paperless process, an individual can open a digital savings account with zero balance and manage their funds from anywhere, at any time. What's more. Open HDFC Bank savings account from your home & get insurance cover up to Rs Cr*. Get preferential loan rates & bank locker with HDFC Bank savings. Customer On-Boarding using TAB. Advantages of TAB Banking Instant digital On Boarding of the new customers in a fully assisted mode at their doorsteps. Read. Enjoy instant banking services on the GO. Paperless account opening through Video-KYC. Open account in your preferred branch digitally. With a DBS Bank Savings Account, you can enjoy modern intelligent banking solutions, including digital gold investments and top-rated mutual fund schemes. IDFC FIRST Bank offers competitive interest rates up to % p.a., one of the bests in industry on digital savings accounts. IPPB's Digital Savings Account is the best way to onboard yourself through the IPPB Mobile App. This app can be downloaded from the play store on your Android. Amaze Digital Savings Account. Initial Funding: ₹10,, Average Balance Requirement. Debit Card fees: Nil, Average Monthly Balance - NIL.

Savings Account customised for individual needs · Amaze Digital Savings Account · Easy Access Digital Savings Account · Liberty Digital Savings Account · Prestige. Saving Bank Account - Open an online saving bank account with SBI. Get mobile & internet banking features with SMS alerts. Bank anywhere using the YONO app. A digital savings account works like any traditional account in its function but is way more convenient. The convenience comes from the fact that a digital. A digital savings account is an online-only account without any physical branches. It is provided by fintechs in partnership with an established bank. All. A Savings Account is a safe place to keep your money & make it grow. ICICI Bank lets you open a Bank Account Instantly. Apply now for a hassle-free. Compare Accounts. Open a Savings Account with India's No. 1* Bank Do it now. Open your Savings & Salary Account instantly from the comfort of your home. What is NiyoX, and what does it offer? ○ NiyoX is your solution to simplified banking. ○ Opening a digital savings account with NiyoX is a breeze. Open Instant Digital Savings & Salary Account Online with HDFC Bank Digital Savings Account, all you need is an working mobile number + Aadhaar + PAN. Open a savings account online with Bank of India in simple steps and avail the benefits such as hassle free banking and competitive interest rates. UBI offers range of savings account that suits your personal needs for the banking. Open your savings bank account online in India now with Union Bank of. Open savings account digitally with YES BANK. Apply for digital savings account from comfort of your home, securely with paperless process & more benefits. Customer can open a bob World Digital SB Account by downloading the Mobile Banking App bob World and registering using their Aadhaar number, PAN and other basic. Bank. Individual customers of age more than or equal to 18 years. Account opening should be initiated from India only. Front camera-enabled mobile device and. A digital savings account is an online-only account without any physical branches. It is provided by fintechs in partnership with an established bank. All. FedBook Selfie is a mobile based Online Saving Bank account opening facility, which is the first of its kind in India. You can open a Savings account through. Banking made easy with our Savings Account that's just a click away. Open digitally with the convenience of using your Aadhaar and PAN Card. HSS Account · Avg. Monthy Balnce? -? · Interest earned. Up to % · Suited for. Individuals · Special benefit. Online banking. Digital Savings Account · %* p.a. onwards · Start From · % p.a.* · % p.a. · % p.a. · Starts From %*. Open instant Digital Savings Account Online at AU Small Finance Bank with Video KYC process. Enjoy 24x7 online banking experience from the comfort of your. Only bank in India to offer Zero Fee Banking on Savings Accounts. Zero charges on IMPS, Debit Card, SMS Alerts & more. Get higher interest rates of up to.

What Can I Use Care Credit On

The CareCredit credit card can be used for routine veterinary appointments, grooming services, emergency pet care, or a variety of surgeries and treatments. * Use CareCredit to pay for deductibles, copays and out-of-pocket expenses not covered by insurance. Pay your AdventHealth bill with CareCredit by calling the. Your CareCredit credit card can be used at over ,+ locations nationwide for a variety of healthcare services including LASIK, Veterinary, Dentistry. CareCredit is a credit card that allows you to pay for dental care without needing cash on the spot. It's ideal for expensive procedures or oral surgeries. What can you use CareCredit credit card for? Use CareCredit to pay deductibles, copays and more. Plus, you can use it at + provider and select retail locations nationwide. Find out more today! Care Credit is just a POS card offered by healthcare providers to patients who need financing. Not meant to help anyone, other than Synchrony. Care Credit is just a POS card offered by healthcare providers to patients who need financing. Not meant to help anyone, other than Synchrony. CareCredit helps you pay for out-of-pocket healthcare expenses for you, your family, and even your pets! Once you are approved, you can use it again and again. The CareCredit credit card can be used for routine veterinary appointments, grooming services, emergency pet care, or a variety of surgeries and treatments. * Use CareCredit to pay for deductibles, copays and out-of-pocket expenses not covered by insurance. Pay your AdventHealth bill with CareCredit by calling the. Your CareCredit credit card can be used at over ,+ locations nationwide for a variety of healthcare services including LASIK, Veterinary, Dentistry. CareCredit is a credit card that allows you to pay for dental care without needing cash on the spot. It's ideal for expensive procedures or oral surgeries. What can you use CareCredit credit card for? Use CareCredit to pay deductibles, copays and more. Plus, you can use it at + provider and select retail locations nationwide. Find out more today! Care Credit is just a POS card offered by healthcare providers to patients who need financing. Not meant to help anyone, other than Synchrony. Care Credit is just a POS card offered by healthcare providers to patients who need financing. Not meant to help anyone, other than Synchrony. CareCredit helps you pay for out-of-pocket healthcare expenses for you, your family, and even your pets! Once you are approved, you can use it again and again.

CareCredit is a health, wellness and personal care credit card that you can use to pay for deductibles, copays and out-of-pocket expenses not covered by. Yes, CareCredit can be used along with your HSA or FSA funds to pay for an eye exam, glasses, contact lenses and more. If you have healthcare costs that exceed. With special financing options,* you can use your CareCredit card again and again for your dental needs, as well as at thousands of other healthcare. CareCredit® helps you pay for out-of-pocket healthcare expenses for you, your family, and even your pets! Once you are approved, you can use it, again and. The CareCredit credit card can help pay for health, wellness, and medical costs with special financing options. Learn how it works and apply today! Whatever it may be, when unexpected out-of-pocket healthcare costs arise, using patient financing to turn that big bill into manageable payments can be a great. You can use your CareCredit credit card at over Rite Aid drugstore locations to help pay for pharmacy prescriptions, personal care, deductibles and. CareCredit is the healthcare credit card designed exclusively for healthcare services with special financing options.* With CareCredit, you can use your card. You can use CareCredit at Rite Aid, Walgreens, Walmart andSam's Club for medical-related purchases, such as prescriptions, as well as other qualifying purchases. The card can be used to pay for expenses incurred through participating doctors, dentists, optometrists, and veterinarians. You can even use the card to pay for. The CareCredit credit card can help you pay for prescription refills, extensions and generic substitutions. Be sure to ask your pharmacy if they accept. Yes, you can use your CareCredit credit card at all Walgreens and Duane Reade locations across the United States. To pay, simply swipe or insert your card. You can pre-qualify for CareCredit online by using its online service at mercurius-digital.ru If you don't want to go online, you can apply over the phone. After your procedure at our facility, you can use the card again and again at more than , providers that accept CareCredit nationwide. CareCredit is. On the website, it says you can use your card for family and even pets. What about someone you're dating? My partner makes K/yr and will pay payments for me. CareCredit is the healthcare credit card designed exclusively for healthcare services with special financing options.* With CareCredit, you can use your card. CareCredit is the healthcare credit card designed exclusively for healthcare services with special financing options.* With CareCredit, you can use your. Your CareCredit digital card can be used for purchases within the network of enrolled providers. View your CareCredit statements and manage your statement. CareCredit is accepted at locations in a national network that includes more than ,+ healthcare providers and health-focused retail locations, as well as.

Spyware Mcafee

McAfee Total Protection · McAfee LiveSafe · McAfee Safe Connect VPN · McAfee Mobile Security for Android · McAfee Mobile Security for iOS · McAfee Virus Removal. McAfee no longer offers the cross-platform antivirus protection of McAfee Modern antivirus utilities handle Trojans, rootkits, spyware, adware, ransomware. Award-Winning Antivirus for Windows PC, Android, and iOS, to protect you from computer viruses. McAfee Antivirus is trusted security for you and your. spyware, e-mail, and instant message protection. To disable virus protection 1. On the Windows taskbar, next to the clock, double-click the McAfee (M) icon. SonicWall Enforced Client AntiVirus and Anti-Spyware software is available for purchase with the McAfee or Kaspersky anti-virus engine. Benefits. Automated/. Product Details · Parcel Dimensions: x x cm; g · Manufacturer: McAfee · Item model number: MAF10ERAA · ASIN: BZGTW. Automatic repairs, McAfee detects and neutralizes the majority of security threats to your PC automatically, with no administration required on your part. Get the best deals on McAfee Anti-Spyware Computer Software and find everything you'll need to improve your home office setup at mercurius-digital.ru Yes, it IS definitely malware. Frankly, the way that McAfee works sneakily and insidiously, without your consent, and without being upfront and clear about. McAfee Total Protection · McAfee LiveSafe · McAfee Safe Connect VPN · McAfee Mobile Security for Android · McAfee Mobile Security for iOS · McAfee Virus Removal. McAfee no longer offers the cross-platform antivirus protection of McAfee Modern antivirus utilities handle Trojans, rootkits, spyware, adware, ransomware. Award-Winning Antivirus for Windows PC, Android, and iOS, to protect you from computer viruses. McAfee Antivirus is trusted security for you and your. spyware, e-mail, and instant message protection. To disable virus protection 1. On the Windows taskbar, next to the clock, double-click the McAfee (M) icon. SonicWall Enforced Client AntiVirus and Anti-Spyware software is available for purchase with the McAfee or Kaspersky anti-virus engine. Benefits. Automated/. Product Details · Parcel Dimensions: x x cm; g · Manufacturer: McAfee · Item model number: MAF10ERAA · ASIN: BZGTW. Automatic repairs, McAfee detects and neutralizes the majority of security threats to your PC automatically, with no administration required on your part. Get the best deals on McAfee Anti-Spyware Computer Software and find everything you'll need to improve your home office setup at mercurius-digital.ru Yes, it IS definitely malware. Frankly, the way that McAfee works sneakily and insidiously, without your consent, and without being upfront and clear about.

Not sure what kind of protection you need? McAfee Security Scan Plus will assess your PC's security posture by scanning key areas of security and helps. McAfee Internet Security watches your back 24/7, stopping new viruses, spyware and other online threats to help you stay safe on every site, including ours. CUNY and Baruch have partnered with McAfee to offer all students, faculty and staff free Virus and Spyware for their personally owned computer systems. Whether. Samsung takes your security seriously and has partnered with McAfee to provide pre-installed anti-malware protection on your Galaxy phone. virus or malicious. McAfee Mobile Security. Keep personal info private, avoid scams, and protect yourself with AI-powered technology. Download the App for Free. - Anti-Spyware. - Validate ANY of the following: Preferred: None - McAfee-AntiVirus-Plus - McAfee-AntiVirus-Plus - McAfee-EPO. - McAfee. Audit item details for DTAM - McAfee VirusScan Access Protection: Anti-Spyware Maximum Protection must be set to block and log scripts from the Temp. Defend yourself and the entire family against the latest virus, malware, ransomware and spyware threats while staying on top of your privacy and identity. McAfee AntiVirus and Anti-Spyware for Student Home Use. Download McAfee AntiScan. In your Browser address box type mercurius-digital.ru 1. Login with. Samsung takes your security seriously and has partnered with McAfee to provide pre-installed anti-malware protection on your Galaxy phone. Flagship Samsung. Among the McAfee security solutions, McAfee Total Protection stands tall with its combination of antivirus virus, malware, ransomware and spyware attacks. Find out how to use McAfee to disable or enable virus protection for your computer. McAfee became the company's most vocal critic in later years, urging consumers to uninstall the company's anti-virus software, which he characterized as. Both McAfee and Norton are great choices for superior antivirus protection. But which one ranks better? Here's how things add up as we pick our winner. As of March 21, , free McAfee subscriptions will no longer be included in Cox Internet plans. Cox Security Suite Plus powered by McAfee is a free service. McAfee Virus Removal Service detects and eliminates viruses, Trojans, spyware and other malware easily and quickly from your PC. It also applies security. The award-winning power of McAfee blocks viruses, malware, ransomware, spyware, unwanted programs and more from your PC, giving you peace of mind. With protection for 10 devices included, you're assured that all your files and personal data are safe from the latest viruses, malware, and spyware. This page. Defend against the latest viruses, ransomware, malware and spyware with our internet security, and keep identity thieves at bay with our VPN and ID. Page 2 of 2 - McAfee finds Prcviewer and Generic PUP [RESOLVED] - posted in Virus, Spyware, Malware Removal: When I try to run mercurius-digital.ru

Sample Of Mutual Funds

:max_bytes(150000):strip_icc()/mutual-funds-101-356319-v3-5b74a06bc9e77c0025fabf28.png)

Mutual funds are shareholder owned investment vehicles which invest in stocks, bonds and other assets or some combination of these assets. Create free mutual funds flyers, posters, social media graphics and videos in minutes. Choose from + eye-catching templates to wow your audience. Most mutual funds fall into one of four main categories – money market funds, bond funds, stock funds, and target date funds. Each type has different features. We've constructed three portfolios using only funds from the Kiplinger 25, a list of our favorite no-load mutual funds, designed for investors with different. Top 25 Mutual Funds ; 2, FXAIX · Fidelity Index Fund ; 3, VFIAX · Vanguard Index Fund;Admiral ; 4, VTSAX · Vanguard Total Stock Market Index Fund;Admiral. ” Each mutual fund may have several breakpoints; the larger the investment, the greater the discount. Sample Breakpoint Schedule. Front-End Mutual Fund. View our mutual fund quotes and sample our research offering. Try our powerful tools to help compare investments and get ideas. View Our Research Providers. WHEREAS, the Adviser serves as investment adviser to the Funds;. NOW, THEREFORE, in consideration of the premises and mutual covenants contained herein, the. Common Types of Mutual Funds · 1. Money Market Funds · 2. Fixed Income Funds · 3. Equity Funds · 4. Balanced Funds · 5. Index Funds · 6. Specialty Funds. Mutual funds are shareholder owned investment vehicles which invest in stocks, bonds and other assets or some combination of these assets. Create free mutual funds flyers, posters, social media graphics and videos in minutes. Choose from + eye-catching templates to wow your audience. Most mutual funds fall into one of four main categories – money market funds, bond funds, stock funds, and target date funds. Each type has different features. We've constructed three portfolios using only funds from the Kiplinger 25, a list of our favorite no-load mutual funds, designed for investors with different. Top 25 Mutual Funds ; 2, FXAIX · Fidelity Index Fund ; 3, VFIAX · Vanguard Index Fund;Admiral ; 4, VTSAX · Vanguard Total Stock Market Index Fund;Admiral. ” Each mutual fund may have several breakpoints; the larger the investment, the greater the discount. Sample Breakpoint Schedule. Front-End Mutual Fund. View our mutual fund quotes and sample our research offering. Try our powerful tools to help compare investments and get ideas. View Our Research Providers. WHEREAS, the Adviser serves as investment adviser to the Funds;. NOW, THEREFORE, in consideration of the premises and mutual covenants contained herein, the. Common Types of Mutual Funds · 1. Money Market Funds · 2. Fixed Income Funds · 3. Equity Funds · 4. Balanced Funds · 5. Index Funds · 6. Specialty Funds.

ETFs and mutual funds both give you access to a wide variety of U.S. and international stocks and bonds. You can invest broadly (for example, a total market. Examples of Mutual Funds. There are eight common types of mutual funds, several of which we have already explored. The eight are money market funds, fixed-. The sample consists of U.S. domestic equity funds in the CRSP sample from to The cross-sectional regressions are monthly, and Newey-West (). We use a large sample of active European and US mutual funds to study investors' and fund managers' reactions to these information shocks produced by the. For example, there are funds with names such as “Portfolio ,” “Retirement Fund ,” or “Target ” that are designed for individuals who intend to. Most mutual funds fall into one of four main categories – money market funds, bond funds, stock funds, and target date funds. Each type has different features. FCS Sample Homework Problems and Answer Key Unit CHAPTER 6. INVESTMENT COMPANIES: MUTUAL FUNDS If a mutual fund's net asset value is $ and the. What are Mutual Funds and How to Invest in Them? A mutual fund consists of a portfolio of stocks, bonds, or other securities and is overseen by a professional. A mutual fund typically focuses on specific types of investments. For example, a fund may invest mainly in government bonds, stocks from large companies or. These funds are generally available for sale to retirement plans, and may also be available to other institutional investors or to individual investors through. Learn the definition of stock mutual funds and understand how mutual funds work. View related terms such as index funds and equity funds and see. Mutual Fund Investment Objective Definitions · Level 1: Long-term funds and money market funds · Level 2: Equity, hybrid, bond, and money market funds · Level 3. The investments must be reported each year on various international reporting forms such as Form , FBAR, and FATCA. Download scientific diagram | Number and NAV of Mutual Funds in Our Sample The table reports annual statistics for the number and NAV of funds in our sample. But these investments also have risks that are usually not present with investments in U.S. stocks and bonds. For example, U.S. investors usually buy foreign. But these investments also have risks that are usually not present with investments in U.S. stocks and bonds. For example, U.S. investors usually buy foreign. For example, by signing an LOI to buy $25, worth of fund shares over the course of a year in $5, increments, an investor can obtain the $25, breakpoint. Mutual fund capital gain “distributions” are broken down into two categories: long-term capital gains (LTCG) which occur when a stock is sold after being held. A complete, but concise, tutorial about mutual funds in a one-page format with sidebars, illustrations, formulas, examples, and clear definitions of basic. MITCHELL CAPITAL MANAGEMENT, CO. January 15, Exhibit A – Portfolio Listing. Exhibit B – General Description of Fund Accounting Services. Exhibit C –.

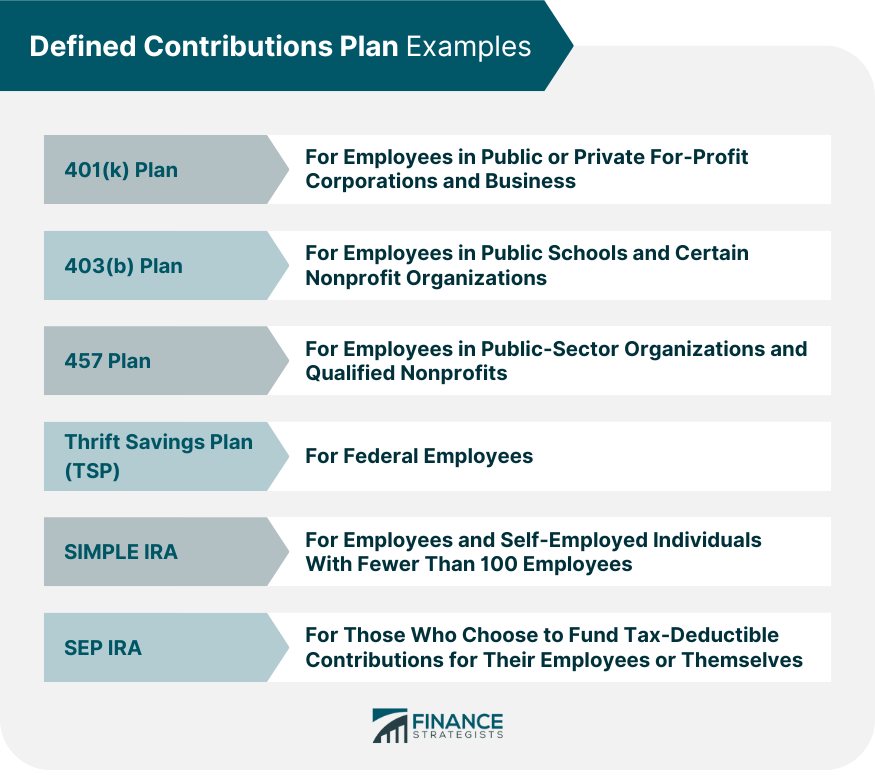

Benefits Of Defined Contribution Plan

A defined benefit plan (e.g., a pension) is one where you know what to expect from your payout when you retire. A defined contribution plan (e.g. There are many advantages to defined contribution plans, the most important of which is that they give employees control over their retirement savings. Defined-benefit plans are funded by employers, while employees make contributions to defined-contribution plans to save for retirement. Under a DC plan, the individual takes on all the investment risk. The DB AdvantageWith a DB plan, members don't have to worry about making investment decisions. Inevitably, some will win and some will lose. DB and DC plans deliver benefits differently. The DB plan channels most of the contributions to those who. Contributions to defined contribution plans are tax deferred, meaning that neither the employer nor the employee pays tax on initial contributions or. Defined contribution plans - (k), profit-sharing, and other defined contribution plans generally pay retirement benefits in a lump sum or installments. A defined benefit plan (e.g., a pension) is one where you know what to expect from your payout when you retire. A defined contribution plan (e.g. DB plans often include subsidies for early retirement: Retirees prior to normal retirement receive a benefit of higher value than those who leave later. If a. A defined benefit plan (e.g., a pension) is one where you know what to expect from your payout when you retire. A defined contribution plan (e.g. There are many advantages to defined contribution plans, the most important of which is that they give employees control over their retirement savings. Defined-benefit plans are funded by employers, while employees make contributions to defined-contribution plans to save for retirement. Under a DC plan, the individual takes on all the investment risk. The DB AdvantageWith a DB plan, members don't have to worry about making investment decisions. Inevitably, some will win and some will lose. DB and DC plans deliver benefits differently. The DB plan channels most of the contributions to those who. Contributions to defined contribution plans are tax deferred, meaning that neither the employer nor the employee pays tax on initial contributions or. Defined contribution plans - (k), profit-sharing, and other defined contribution plans generally pay retirement benefits in a lump sum or installments. A defined benefit plan (e.g., a pension) is one where you know what to expect from your payout when you retire. A defined contribution plan (e.g. DB plans often include subsidies for early retirement: Retirees prior to normal retirement receive a benefit of higher value than those who leave later. If a.

The Defined Contribution Plan is the retirement savings plan offered to newly hired and current employees through the University. The IRS requires that a defined benefit plan be used as a tool to provide for retirement income and not solely as a tax shelter. Under normal circumstances, you. They generally favor younger employees who have a longer time horizon until retirement. Defined Benefit Pension Plans promise participants a specific monthly. Defined benefit plans provide a predetermined payout. Defined contribution plans require or permit employees, and sometimes employers, to make contributions up. Defined contribution (DC) retirement plans allow employees to invest pre-tax dollars in the capital markets, where they can grow tax-deferred until retirement. Defined contribution plans include profit sharing, (k) and money purchase plans. Each participant has their own account and assumes the investment risk. A defined benefit plan, such as a pension, is a retirement account for which your employer does all the work, including ponying up the money and deciding. Defined benefit plans provide a fixed, pre-established benefit for employees at retirement. Employees often value the fixed benefit provided by this type of. Defined contribution plans can be offered as the primary retirement plan or as a supplemental retirement plan. Separate best practices have been adopted for. Defined Benefit Plan. Defined Benefit Plans may allow for much higher contributions than Defined Contribution Plans, such as (k) Plans. However, in a Defined. A defined contribution plan is an employer-sponsored retirement benefit in which the employer provides a retirement savings vehicle for its employees. These are different from defined benefit plans, which are professionally managed so employees don't have to research investment options. Defined benefit plans. The District government's primary retirement plan for eligible employees first hired on or after October 1, , is a "defined contribution" plan. Shifting public education employees from a secure defined benefit pension system to a risky defined contribution plan has been contemplated by some in the. Plan Highlights. In the SERS defined benefit pension plan, your benefit is defined by a calculation that considers your years of service and salary. Your. Your plan is administered by Fidelity Investments. · Your benefit is based on the market value of your account. · While you were working, your employer. Limited funds to choose from – a benefit of a defined contribution pension is that you, the employee, get to pick in what to invest your funds. Unfortunately. What is a defined contribution health plan? A defined contribution health plan is a type of employer-sponsored benefit plan where the employer contributes a. Your plan is administered by Fidelity Investments. · Your benefit is based on the market value of your account. · While you were working, your employer. A defined benefit plan is typically not contributory— i.e., there are usually no employee contributions. And there are usually no individual accounts maintained.